Cross Border Payment Gateway

The Best Way to Process Cross-Border Payments Is Locally

Thanks to technology, accessibility and the Internet, our world has gotten smaller. We can easily communicate, work and even sell across borders. As businesses look to expand, introducing products and services to new geographies is the natural next step.

International selling is the future. It’s true that domestic eCommerce is growing, but cross-border eCommerce is exploding. Consider these statistics to see how enabling cross-border payments could put your growth in hyperdrive.

If you’re selling online, then there’s a chance you’re already starting to sell cross-border. To grow effectively on an international scale, you need a good way to manage cross-border payments – transactions that involve an exchange of money across the border of a country or region – while avoiding unnecessary cross-border fees and the pitfalls of global compliance.

Yet, when we asked companies about how they localize payments for their global customers, only 50% sold in customers’ local currencies and a full 15% of respondents took no localization action whatsoever! That’s neglecting an increasingly important area of sales and business growth and creating the likelihood of checkout abandonment.

What Are Cross-Border Payments?

Cross-border payments, or cross-border transactions, involve any exchanges of money that cross the border of a country or region, starting in one jurisdiction and ending in another.

When banks process cross-border payments, they perceive them to be riskier than domestic transactions. This perceived risk leads to higher fees and a greater likelihood that the transactions could be declined.

Types of Cross-Border Payments

Cross-border payments can take any of the same forms as domestic payments so it’s important to be able to accept all types of payments, including types native to the particular countries where your customers are located. Two of the most popular payment types, that can also incur cross-border fees, are credit cards and eWallets:

Debit and Credit Card payments

Perhaps the most traditional form of cross-border payment is an online card payment. This is a transfer of money via a card issued by a financial institution, typically a bank, that gives an individual access to their own funds or a line of credit.

eWallet payments

eWallets, or digital wallets, are a type of software application that stores an individual’s payment information to allow the digital transfer of funds between users. They are often used through mobile payment devices, such as smartphones or tablets.

How Cross-Border Payments Work

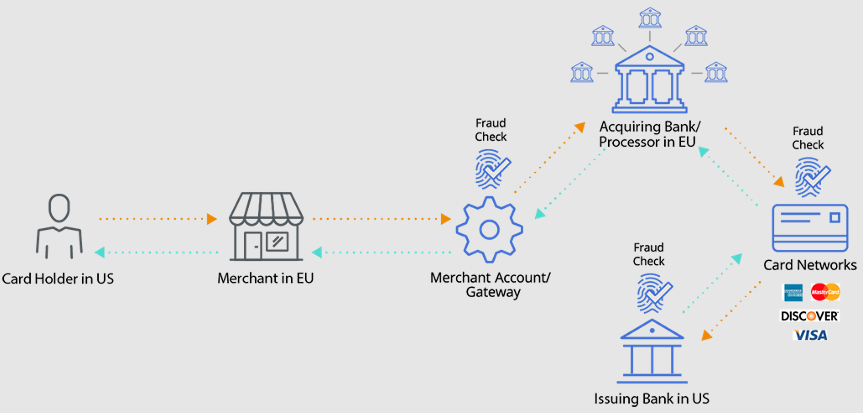

Payment processing follows the same seven steps whether a transaction is domestic or international. However, cross-border payments have some additional considerations that, if addressed, will help you make the most of your international sales. Here’s how they work:

1. The customer purchase: Your customer arrives at your checkout page, shopping cart filled with merchandise (or services or software), ready to make a purchase. They choose a payment method and enter any required information associated with it.

For cross-border payments: To make cross-border eCommerce a success, this step requires some extra attention — a localized checkout experience. The checkout page should always be presented in the shopper’s language. According to a global survey, 76% of shoppers prefer to purchase products presented in their own language and 65% prefer website content that’s in their language, even if it’s of poor quality.

Not only does this make the customer feel more comfortable navigating the page, but it also feels more like a local shopping experience, making it more likely that customers will see the process through. A payment gateway with an emphasis on cross-border transactions will detect the shopper’s IP address and serve up the appropriate experience.

Similarly, the price of your goods should appear in the shopper’s local currency. This is important for two reasons: One, it helps your customer know exactly how much they’ll be paying, without making them jump through hoops by doing currency conversion calculations. Two, it’s more likely that the transaction will be approved by the acquiring bank (see step #2). Again, a simple IP check by your payment provider should provide the shopper with what they need.

Lastly, your checkout page should offer local payment methods — no matter what country your shopper is in, they should be able to choose whatever method of payment they use normally. Without local payment options, you risk losing the sale altogether; at the very least, your customer won’t be completely satisfied with the experience.

2. Routing and processing: In this step, the customer’s card information is captured and encrypted by the payment gateway. The gateway then sends an authorization request along with the transaction information to an acquiring bank — the bank or financial institution that processes credit or debit card payments on behalf of the merchant (you). The acquiring bank then sends the request to the issuing bank — the shopper’s bank — to request approval to process the transaction.

For cross-border payments: To conduct cross-border eCommerce transactions more effectively, a payment solutions provider should partner with numerous acquiring banks around the globe. Some payment providers only have one acquiring bank partner, so it’s important to check! Why? A one-bank partnership sets up global payments for failure. If the acquiring bank is located in the US and the shopper’s bank is in another country, that transaction has a much higher probability of being flagged for fraud.

3. Approval: In the approval phase, the issuing bank either approves or denies the request. That decision might seem like a no-brainer — either funds are available or they’re not — but the decision is based on a few different factors, including availability of funds, transaction value, etc.

For cross-border payments: Approval becomes more challenging for cross-border payments because there is the potential for more risk. Banks consider the same factors when authorizing any transaction, but with international sales, there’s more likely to be a mismatch:

Funds: Are the funds available to cover the amount of the transaction?

Transaction value: Lower value transactions have a better chance of being approved as higher value transactions are seen as higher risk. If you have higher ticket items, you might consider offering a subscription plan to be able to offer lower value transactions to increase the chances of approval. For example, rather than charging $120 a year to access your software, charge a monthly $10 fee.

Currency mismatch: If the currency request doesn’t match the issuing bank’s local currency, the transaction is more likely to be declined.

For cross-border payment processing, the approval step goes more smoothly when transactions are routed to the banks most likely to approve them — banks that are a good match geographically and that fit the transaction’s currency and issuing bank or country. This type of “intelligent” routing helps increase approval rates.

4. Shopper results and confirmation: Once the issuing bank has made a decision, it informs the acquiring bank, which authorizes the transaction and then informs the customer via the checkout page as well as you, the business.

All of these steps happen in about a second.

How to Accept Cross-Border Payments

If you’re interested in being able to accept cross-border payments, with a minimum of hassle and fees, then there’s a few important things you’ll need to consider:

Where your customers are located. This will dictate the languages that you’ll need to support as well as required compliance and taxes they may need to pay.

How your customers will want to pay. You’ll need to be able to provide the currencies and payments that they’ll want to use where your business is located. Leveraging all your legal entities can help you create the right connections to local financial institutions.

Processing cross-border payments has a lot of moving parts, and the more regions you serve, the more payment types you need to accept and the more banks you need to work with increases your payment complexities.

Thankfully, there’s a fourth consideration for accepting cross-border payments: Which payment provider will you choose?